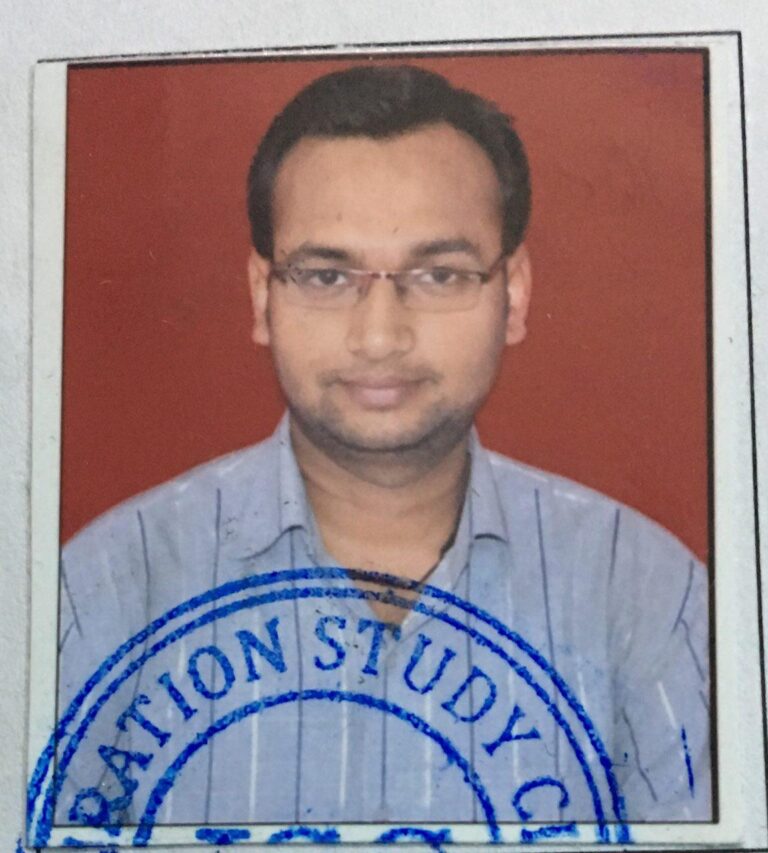

Inspiration Study Circle, Dehradun, delivered an exceptional result with Nine successful selections. “Heartiest Congratulations on Qualifying the Civil Services Exam 2022 - 2023 ”

Five candidates have successfully secured their places in the UPSC Civil Services Examination. Their achievement stands as a testament to their dedication and hard work. Read more

Enquire Now

Director's Message

Dear Students,

Here at Inspiration Study Circle : Best IAS/PCS Coaching in Dehradun, welcome. In this position, your loyalty and zeal will be combined with your years of rich expertise in directing and navigating the young people of the country to fulfill their potential and lead the growth of the country.

Welcome to the welcoming academic community and the compassionate learning environment.

First of all, I want to congratulate everyone for moving on and choosing to pursue a career in the civil service. Bravo to everyone because joining the civil service offers you more than just a good career to support yourself; it also gives you the chance to reach your full potential,

like your work, and avoid the limelight. Together with the responsibilities listed above, as it is properly said, “With Big Power Comes Great Responsibility,” you will also have the duty to serve and ultimately lead the country by serving as its public face.

Over various stages of the examination, the UPSC Civil Services Examination (CSE) gauges a candidate’s endurance and adaptability for the highest rank jobs in the Indian bureaucracy.

A candidate should exhibit administrative qualities such as intellectual and moral integrity coupled with social qualities such as mental alertness, critical assimilation power, clear and

logical explanation, balance of judgment, diversity and depth of interest.

At Inspiration Study Circle:Best IAS/PCS Coaching in Dehradun, we share your passion for following your dreams, and we are committed to being at the forefront of knowledge distribution and programme delivery. Also, we give equal weight to both research and knowledge creation, and we have attracted

young, experienced academics whose curiosity and talent will lead this purpose. Thus, success will come from a mix of your diligence and wise instruction.

Inspiration Study Circle- The Best UPSC/PCS Institute “Nobody teaches GS as we do!”

Inspiration Study Circle, ISC, has been the best Civil Services Training Center in Dehradun for the last 14 years for candidates who want to join All India Civil Services and State Public Civil Services.

Located in the fair metropolis valley of Dehradun, ISC is known for its excellent preparation and guidance for students appearing in Civil Services and Public Services Examinations. ISC has been ranked as the best IAS coaching institute in Dehradun and the whole of Uttarakhand. It has been classified as a top institution for IAS, IFS, PCS, IFOS, and other Civil and Defence Services Exams like CAPF, CDS, and AFCAT.

The classes at our institute are designed to provide students with the best possible foundation for their preparation journey.

ISC’s faculty, curriculum, and lectures are designed for better critical understanding, self-directed learning, and revision.

Why Inspiration Study Circle is the best IAS Coaching Centre in Dehradun?

Inspiration Study Circle is an IAS, PCS, CAPF, CDS, AFCAT, and other Civil Services Exam and Coaching Institute in Dehradun. With its dedicated faculty, comprehensive curriculum, introductory study materials, and personal attention, the institute offers aspirants the perfect mix for preparation and extraordinary results.

If you are a candidate who wants to join All India Civil Services, Central Civil Services, or Defense Services, consider enrolling in ISC to get the best experience in learning and training. ISC will guide you to achieve your goals

- The Lectures are so designed by our experienced faculty that they can be easily understood and learned.

- Inspiration Study Circle stands out for being the best training institute with an out-of-the-way feature of providing simplified but detailed Current Affairs and blogs on a daily, as well as monthly basis.

- We have covered the entire syllabus of IAS/PCS in our course in our study material.

- Emphasis on the areas that yield maximum questions.

- Inspiration Study Circle takes on various streams for a better course of action depending on the location and preference of the candidates.

Affordable IAS Coaching Fee Structure in Dehradun

Inspiration Study Circle provides various courses for convenience and ease of access according to the location and preference of the candidates.

These courses are designed on different fee structures that may suit the students as per their requirements. ISC has been admitting candidates from all over India. Thus, we have introduced the following line of courses:

- Offline Course- for UPSC/PCS Pre plus Mains.

- Pen Drive Course- with UPSC/PCS Documented Study Material

- Distance Learning Program- with UPSC/PCS Study Material and Vide

- NCERT- GS Foundation Course

- Pre plus Mains Course- for answer writing practice

- Mains Online Course- for UPSC/PCS Pre plus Mains

- Exam Writing Course

- Mock Interview Course

- Test Series Course for UPSC/PCS Pre and Mains

Batch Timings for IAS Coaching in Dehradun

ISC brings ease of learning and preparing for the Civil Service Exams by providing different batch timings for the different batches and courses.

ISC is the only UPSC and Civil Services Coaching Institute in Dehradun that provides preparation classes all through the week, from Monday to Sunday, all seven days.

The various batch timings at the ISC IAS/ PCS coaching center are:

- IAS/PCS/CAPF Pre Plus Mains Evening Batch: Evening Classes from 3: 30 p.m. to 8: 00 p.m. These Timings are set to provide comfortable batches for college/officer goers.

- IAS/PCS/CAPF Pre Plus Mains Morning Batch: Morning Classes from 8: 30 a.m. to 11: 30 a.m. These batches run in Hindi medium, especially for the candidates appearing in the exam in the second official language, i.e. Hindi.

- IAS/PCS/CAPF NCERT- GS Foundation Batch: Morning Classes for the students who want to put up a foundation for their preparation with NCERT basics.

- CSAT/Current Affairs/Newspaper Analysis Class: Weekend Classes for these batches every Friday, Saturday, and Sunday for continuous and regular learning.

Offline Smart Classes for IAS/ UPSC Preparation

Inspiration Study Circle (ISC), the best IAS/PCS coaching institute in Dehradun, hereby introduces you to its one major key factor, i.e., Smart/ Hybrid Lectures for UPSC/PCS Preparation. The program focuses on imparting knowledge and sources to hard-working aspirants with unique and penetrable techniques.

- We conduct detailed classroom lectures with a small batch at a time to encourage more student-teacher interaction.

- Each lecture is an equipped smart class for better and more conducive understanding.

- Access to classroom discussions and easy student-teacher interaction.

- Detailed notes for Prelims as well as Mains.

- Discussion on critical, current, and contemporary topics within the class itself.

- Access to ISC’s Mobile Application.

- Recorded Video lectures of live classes for every topic taught daily (available in Hindi and English) on the app.

- Comprehensive data and information on Current Affairs (Daily and Monthly basis).

- Weekly online test Series.

- In-depth GK and GS Study Material.

- Complete guidance and support through telephone and text message communication.

Online Classes for IAS/ UPSC Preparation

Inspiration Study Circle (ISC), the top IAS/PCS and Civil Services coaching institute in Dehradun introduces its much-required Online Learning Program. The program focuses on imparting knowledge and sources to hard-working aspirants all around the country.

- Live Lectures through an online meeting/classroom portal.

- Access to classroom discussions and easy student-teacher interaction.

- Detailed documented material for Prelims as well as Mains.

- Access to ISC’s Mobile Application.

- Recorded Video lectures of live classes for every topic taught daily (available in Hindi and English) on the app.

- Comprehensive data and information on Current Affairs (Daily and Monthly basis).

- Comprehensive data and information on Current Affairs (Daily and Monthly basis).

- Weekly online test Series.

- In-depth GK and GS Study Material.

- Complete guidance and support through telephone and text message communication.

- Provision of detailed live online lectures, as per the timetable provided.

- Daily classes for 3- 4 hours, allowing students to be regular with each subject and save time for day-to-day revision.

- The availability of live lectures allows candidates to not only attend classes on the go but also interact with the lecturers within their comfort zones.

- Admission of the candidates to the WhatsApp and Telegram groups/channels for the latest keys.

- Availability of regular newsletters and editorials of major publications concerned with current affairs and global issues.

- Smart classes for better understating through diagrams, maps, and graphical interfaces.

Our Methods and Principles of Teaching

Accomplished and Skilful Faculty: The faculty at Inspiration Study Circle (The Best IAS PCS Coaching in Dehradun) are experienced and qualified teachers who understand the complexities of the Civil Service Exams. They provide the aspirants with comprehensive guidance and mentorship and help them build a strong foundation in all subjects.

Extensive and Inclusive Curriculum: The detailed lectures at ISC cover all the essential subjects and topics that are assessed in the Civil Services as well as Defense Services exams. The curriculum is designed to give students a comprehensive understanding of the subject and build a strong foundation for their journey.

Routine tests, assessments, and evaluations: ISC, is not just the top civil service, IAS, PCS, and Defense Service Training Institute in Dehradun because of its valuable faculty and elaborated study plans, but also because of its exemplary preparation strategy.

The institute conducts regular tests and assessments to help students track their progress and identify areas where they need improvement. This helps students to prepare better for their exams and to achieve their desired scores.

Delivery of Daily and Monthly Current Affairs: Current Affairs and the Latest Global topics are a crucial part of the preparation for clearing any Exam. These also become the biggest pain points for the candidates.

Inspiration Study Circle stands out for being the best Civil Service coaching institute in Dehradun with this out-of-the-way feature of providing simplified but detailed Current Affairs on a daily, as well as monthly basis.

Detailed Study Material and Notes: ISC reflects a top Coaching center in Dehradun for a perfect study plan for Civil, State, and Defense Service aspirants. It provides candidates with comprehensive study material, including notes, books, and question papers, to help them prepare well regularly.

Success Stories in UPSC- CSE 2022

The UPSC CSE Prelims exam was held on 5th June 2022 and the results were declared on 22nd June. The main examinations were conducted from September 16 to 25, and the results were announced on December 6. The session interviews ended on May 18.

Inspiration Study Circle, Dehradun, delivered an exceptional result with four successful selections:

- Gagan Singh Meena

- Yash Pal Singh

- Rajat Singh

- Divyansh Meena

Out of the 19 candidates who faced the final round of Personality testing, our four prodigies stood out with a notable result.

How can ISC contribute? What do we offer?

Proper, and complete guidance makes a candidate’s journey and preparation not only easier but will lead the candidate head-on. After all, there is no harm in going the extra mile.

Inspiration Study Circle: the best IAS/ PCS Coaching institute in Dehradun provides candidate-friendly programs for the finest results in the UPSC Civil Services Exam

- We conduct detailed classroom lectures with a small batch at a time to encourage more student-teacher interaction.

- A daily average class duration is of about 3- 4 hours providing the candidate enough time for self-study and practice.

- Each lecture is an equipped smart class for better and more conducive understanding.

- Digital classrooms following the hybrid teaching method.

- Conduction of online classes for those candidates who are unable to attend physically.

- Provision of monthly current affairs.

- Discussion on critical, current, and contemporary topics within the class itself.

- Regular study material.

- An approach to teaching that covers prelims and mains together.

- A series for writing practice for main exams.

- Test Series for Prelims and Mains.

- Mock Interviews with some distinguished personalities.

A Note from the Director’s Desk

ISC, Dehradun has a good focus on a student-oriented approach and intensive subjects. This is not only discussed in class but also provided to students through various digital media and hard-copy manuals.

The Director of Inspiration Study Circle, Dehradun, Mr. Nisheeth Saxena, is an expert in General Studies and Geo-political issues.

The aspiration for UPSC exams can be very rightly expressed in the words of the Great Missile Man of India Dr. A. P. J. Abdul Kalam, “A dream is not what you experience in your sleep. A dream is that which does not let you sleep.”

Your dream can always become a reality once you start aiming for it in your awake state. Understand and get familiar with the syllabus. Brush up your basics with NCERT books. Your target should be your priority. Regularity and revision should become your rituals. It should be kept in mind that UPSC demands an analysis of a topic. It aims at evaluating your critical thinking and decisiveness.

Adapt the “Read and Stay Updated” strategy.

Join us and conquer!

Inspiration Study Circle, Dehradun

vansh stunt bicycle video2023-02-01Best

vansh stunt bicycle video2023-02-01Best Vinod Singh Rana2023-01-28Good ok

Vinod Singh Rana2023-01-28Good ok Shadab Ahmed2023-01-28Excellent 👌👌 App

Shadab Ahmed2023-01-28Excellent 👌👌 App abdul jabber2023-01-28Very good

abdul jabber2023-01-28Very good Nitin Sonkar2023-01-26Best

Nitin Sonkar2023-01-26Best Sunny Kumar2023-01-26Thumps Up

Sunny Kumar2023-01-26Thumps Up Tanuja Gusain2023-01-25Good 👍

Tanuja Gusain2023-01-25Good 👍 Ashu Yadav2023-01-24Great

Ashu Yadav2023-01-24Great Palak Birla2023-01-22Good bestGoogle rating score: 4.9 of 5, based on 228 reviews

Palak Birla2023-01-22Good bestGoogle rating score: 4.9 of 5, based on 228 reviews

Our Major Selections till 2022

Download Our App From Playstore for Courses Like UPSC IAS State PCS CISF AC CDS/ AFCAT

Our Top Notch Courses